PAREX Resources Q1 2024 Update

The Stock Price may wiggle but the dividend will remain resilient

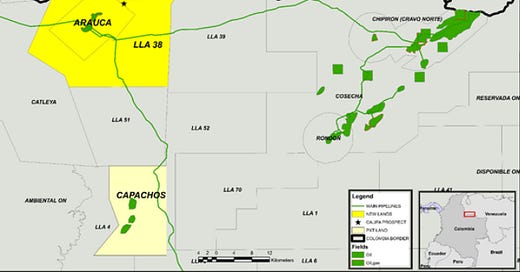

This is an update to my original article on Parex Resources, in which I go over how to intelligently invest in commodity companies, using Parex as the example. Recall that Parex Resources is the largest independent oil and gas producer in Colombia, and they mainly operate in the Llanos and Magdalena basins.

On, May 8th, 2024, Parex released its Q1 2024 results and there are several things I’d like to highlight and discuss.

*Disclaimer: I am long PARXF at an average price of $15.86

Their Production:

During Q1, Parex produced 53,338 barrel of oils equivalent per day of oil and natural gas. I could equally say 53,338 barrels of oil since 99% of their energy production is oil. This was below the 57,000 boe/d production guidance for 2024, but this miss is due to the disruptions at the Northern Llanos operations because of ongoing social protests in the region that began on January 22, 2024. As a result, production in Capachos Block in Northern Llanos was halted. It has since resumed production, and management continues to guide for 57,000 boe/d for the remainder of 2024.

Total Forward production guidance:

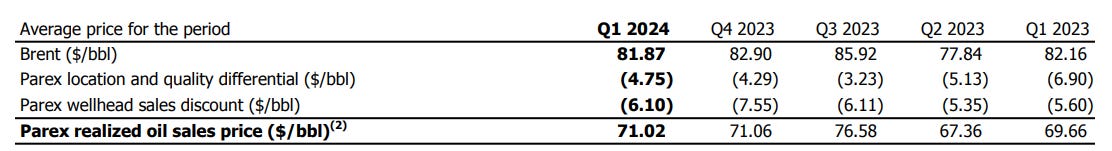

Parex usually receives $10-$12 U.S. dollars per barrel of oil equivalent below the Brent price. For the first quarter, their average realized prices was $71.02.

Shareholder Returns:

Buybacks: Shares outstanding were reduced from 105,162,163 to 103,106,857 which represents a 2% decline in shares outstanding.

Dividends: The first quarter dividend was 0.27 United States Dollars per share. Parex is increasing the quarterly dividend to 0.28 United States Dollars per share.

Cash Flow and Capex:

The cashflow statement says that they produced 97.4 million dollars in cash from operations. However, this is an accounting number. When I look at cash flows, I disregard one-time events like their substantial changes in working capital (50,895). Not to worry, I make sure to include balance sheet health later in my valuation which considers changes in working capital. Therefore, when I look at the operations of Parex and what this business produces, I would add back the change in working capital which would give an operational cash flow of 148.3 million for Q1 2024.

Parex’s rule on capital expenditures is governed by the rule that 1/3 of cash flow from operating activities must be returned to shareholders via dividends or buybacks. Given that Parex generated 148.3 million from operations, this would give them the ability to spend up to 98.8 million in capital expenditures. However, they only spent a total of 40.8 million maintaining existing production and 44.59 million on exploitation. For the entire year, Parex is targeting 375-450 million in capital expenditures, so currently they are at the low end of their guidance. Regardless, Parex’s policy of retuning 1/3 of operating cash flow to shareholders makes forward guidance very transparent.

Costs:

The only thing I wanted to comment on here is the growth in production costs on a per barrel of oil equivalent.

From Parex: “Colombia has experienced an El Niño-induced drought that has led to an escalation in power costs across the country during the past year. Colombia is heavily reliant on hydroelectric power. In late April 2024, power costs have begun to decline, with the expectation that full year 2024 operating costs will be within the original guidance range of $10-12/boe”.

I believe that production costs will need to be monitored in the future, but a normalizing of production costs back down to 10 dollars would be very bullish. I calculate an additional 17 million dollars per year in free cash flow for each dollar decline in production costs.

Valuation:

Given that management has outlined their production guidance and capex guidance for the next three years, I will calculate the free cash flow for Parex for the next three years and then assign a conservative terminal value based off the free cash flow. This valuation assumes an average $80-dollar brent price:

At a 12% interest rate, I give Parex Resources a $19.7 fair value per share. At the current buyback rate and share, here is the projected FCF Per Share, FCF Yield, and Dividend Yield.

You might think my fair value estimate is low at $19.7 per share, and the main reason it’s not higher is due to the fact that bond yields on Colombia have risen substantially over the past three years, so I applied a 12% discount rate. At an 8% discount rate for example, Parex would be worth $32 dollars per share. If the Leftist President Gustavo Petro loses his re-election bid, bond rates in Colombia will go down and Parex will receive a massive re-rate in price.

One Final Thought:

In my opinion, unless you’re buying an extremely high-quality company like Microsoft of Pepsi Co, that are almost guaranteed to have a higher stock price in five years, you have to have a certain mindset. That mindset is, “If nobody else buys this, how can I still get paid?”

In the case of Parex, one year, two years, and three years from now, I project a dividend yield of 8.49%, 10.69%, and 14.05% on your original investment at today’s stock price. In other words, analysts can tweak assumptions like a discount rate and argue what they think a fair value per share is. Regardless, we will still get paid a hefty yield.