Hershey a Unique Cocoa Play

Consumer Defensive Equities have performed quite poorly over the past year.

Headwinds for consumer defensive stocks:

1. The perception of weight loss drugs: The global anti-obesity drug market is projected to grow from $4.5 billion in 2023 to $22.9 billion by 2030[1]. The long term affect of weight loss drugs on the earnings per share on consumer defensive companies isn’t currently quantifiable.

2. Gen-Z is less loyal to brands than older generations: According to a survey by Morning Consult, just 53% of Gen Z-ers say that there are brands they are loyal to, compared to 61% of all other adults [2]. This will be something to be aware of as time goes on.

3. Higher Yields: This is a headwind for all equities as higher rates increase the borrowing cost of corporations while simultaneously decreasing the net present value of future cashflows. Income oriented investors might be inclined to trade their steady dividend streams for bonds.

Chocolate has Been Particularly Beaten Down

I have two investment strategies that I employ. First is looking for high quality compounders at reasonable prices. These are the types of companies that can consistently grow earnings and revenue and do dividends and buybacks. The second is looking for contrarian bets on stocks likely to have a recovery on investor sentiment change. I believe that Hershey will satisfy both investment styles.

Hershey has underperformed the consumer defensive sector by 12% over the past year. I believe the main reason to be the historically high cocoa prices over the past six months, and a possible second headwind is the new competition from Feastibles.

What’s going on with Cocoa?

There are two factors that have contributed to the increase in cocoa prices over the past six months:

Political and economic instability in major cocoa-producing countries, such as Côte d’Ivoire and Ghana, which account for over 60% of the world’s cocoa output. These countries have faced civil unrest, currency devaluation, and export disruptions that have affected the supply and quality of cocoa beans [3].

Weather events have reduced the cocoa yield and increased the risk of pests and diseases. For instance, West Africa experienced heavy rainfall and a black pod disease outbreak in 2022. A mix of heavy rainfall and a black pod disease in West Africa have crunched supply, driving up the price of cocoa. The spread of the disease, which causes cocoa pods to turn black and rot, could result in lower cocoa crop quality and production and push the global cocoa market into a third year of deficit for the 2023/24 season. To quantify how strenuous the situation has gotten, data from the Ivory Coast government showed Ivory Coast farmers shipped 479,449 MT of cocoa to ports from October 1-November 27, down -32.2% from the same time last year[4]. An El Niño, a weather phenomenon that brings hotter and drier conditions to the tropical Pacific, is also expected to affect the cocoa harvest in the coming months. To put this into perspective, a similar weather even reduced cocoa production by 5.5% from 2018 to 2019[5].

Feastibles, the New Competitor:

The new kid of the block is Feastibles. Feastibles is a snack brand produced by James Donaldson (Mr. Beast) who is a youtuber with almost 229 million subscribers. In January 2022, he launched a new series of chocolate bars. The effect of this is not currently quantifiable, but this is creating negative investor sentiment around confectionary businesses like Hershey. I believe that James is bringing in young people to the chocolate market that never would have been there otherwise. Maybe a portion of these customers will be inclined to buy a Hershey bar that costs anywhere from $1 to $1.50, while a Feastible bar is $3.

Negative Sentiment Creates Fantastic Entry Points

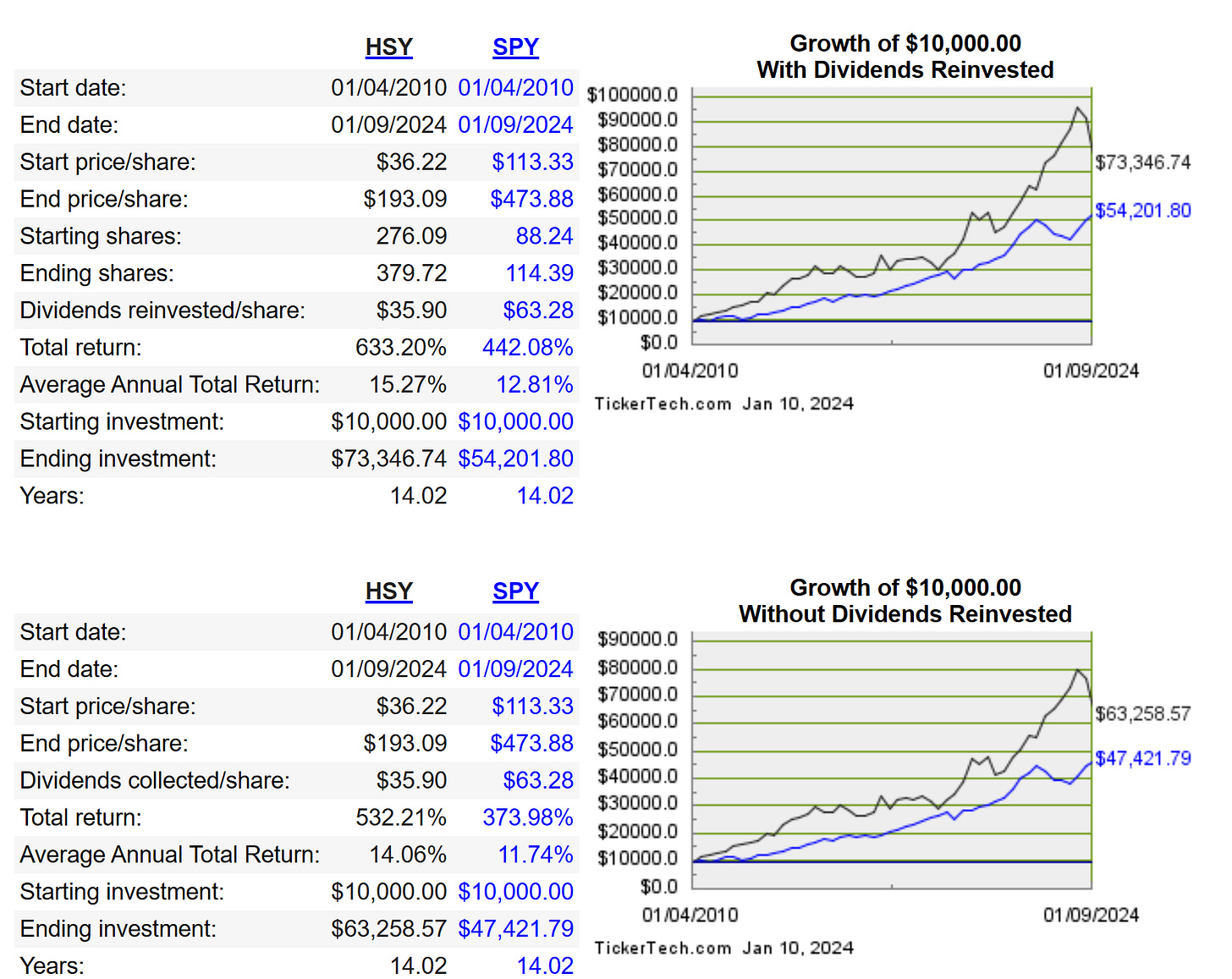

First and foremost, Hershey is a high-quality compounder. Over the past thirteen years, Hershey has growth EPS at a rate of 11.9%, revenue at 4.89%, quarterly dividend at an annual rate of 9%, reduced the share count by 10.8%, and has had an average return on invested capital of 25%.

Despite the above being true, that has not prevented the 14.33% sell of we’ve seen this past year. The reason is that ninety percent of Hershey’s operating income is related to their North American Confectionary business segment, and cocoa prices have surged 60% over the past year, likely putting pressure on Hershey’s operating margins. “Likely” because Hershey hedges commodity prices; regardless of the price of cocoa over the past ten years, they’ve been able to maintain operating margins in the low to mid 40’s (well above competitors like Mondelez). Hershey has not provided enough clarity around their commodity hedging to determine how they’ll be impacted by 4000 USD/T cocoa, but what determines price action is perception, and historically high cocoa prices is going to be seen as a negative for large chocolate makers.

Many value investors might be inclined to wait until cocoa prices come down to invest. However, commodity investors know that high prices cure high prices. In the long run, this cocoa price is not sustainable. Falling cocoa prices will be a fantastic tail wind for Hershey; they will not only improve their operating margins, but they will likely receive a multiple expansion as well. Historically, Hershey trades in the mid 20s in terms of earnings multiple, and they are currently fluctuating between 19 and 20 times earnings.

Do I know when cocoa prices will fall? I don’t but while you wait, you get to collect a 2.5% and growing annual dividend from a high-quality compounder.

The Global Demand for Chocolate is only Growing:

In emerging markets, especially in Asia, consumers are developing a taste for premium and dark chocolate varieties. According to the International Cocoa Organization (ICCO), the global cocoa consumption increased by 2.5% in 2022, reaching 4.8 million tonnes[6].

Currently, Hershey only derives 3.3% of its sales from its international. However, Hershey is trying to break into markets where per capita chocolate consumption is low. So far, Hershey has had early success in India where it now ranks first in syrup and second in chocolate spreads, with sustained growth and increasing market share in chocolates, syrup, spreads, and milkshake categories. Over the coming decade, per capita chocolate consumption in India is expected to grow at 6.64%[7]. This provides incredible growth opportunities for Hershey.

Hershey is also expanding into Salty Snacks:

Hershey has taken the approach of acquiring existing snack brands, and then using their distribution and marketing network to grow these existing brands. They acquired skinny pop popcorn and dots pretzels recently. As of Q3 2023, their segment income for salty snack brands has increased by 17% since Q2 2022. Salty snacks currently provide 6.1% of the operating income.

2023 Full-Year Outlook

Current Guidance

Net sales growth ~8%

Reported earnings per share growth 13% - 15%

Adjusted earnings per share growth 11% - 12%

Conclusion

Hershey is a high-quality compounder that has consistently grown its EPS, dividends, revenue, all while maintaining a wide brand moat. The recent rapid rise in cocoa prices and new competition has resulted in negative investor sentiment.

This creates a long-term entry opportunity for investors who like to buy and hold long term quality compounders that pay dividends. For commodity-oriented speculators, they should buy and wait for cocoa prices to inevitably fall. While they wait, they’ll be paid a 2.5% dividend.

[1] Obesity Drug Stocks: Where to Invest Now | Morningstar

[2] Mind the Gap: Loyal Z: Why Gen Z customers won't be tied down to one brand (mckinsey.com)

[3] Foodflation: First It Was Orange Juice, Now Cocoa Prices Jump Sky-High (businessinsider.com)

[4] Cocoa Prices Retreat After ICCO Cuts its 2022/23 GLobl Cocoa Deficit Estimate | Nasdaq

[5] Global Market Report: Cocoa prices and sustainability (iisd.org) page 4

[6] Cocoa Statistics - August 2023 Quarterly Bulletin of Cocoa Statistics (icco.org)

[7] Chocolate Industry in India - Market Size & Share (mordorintelligence.com)